Identifying the right auto insurance can sometimes feel overwhelming, especially with numerous options out there. As a car owner, understanding your insurance needs is essential not only for your reassurance but also for your financial security on the road. Whether you are a beginner driver or have been behind the wheel for a long time, picking the best car insurance policy that meets your lifestyle and budget is a decision you ought not to take lightly.

Auto insurance provides you with coverage against a variety of risks associated with driving, such as accidents, theft, and liability for damage to other vehicles. With different types of coverage and different policy limits, it is essential to evaluate your specific needs and preferences. By taking the time to carefully evaluate your options, you can ensure that you are sufficiently covered without overpaying for unnecessary features.

Understanding Automobile Coverage Basics

Car insurance is a policy between a policyholder and an provider that gives fiscal security against damages related to car ownership. When you acquire vehicle insurance, you consent to pay a premium in exchange for coverage that assists protect you against various risks, including accidents, theft, and harm. The contract defines the responsibilities of both sides and the conditions under which requests can be filed.

There are several types of car insurance provided to vehicle owners, including liability coverage, impact coverage, and comprehensive coverage. Liability coverage is required in most regions and covers amounts associated with harm to third parties or assets if you are at fault in an accident. Collision coverage assists take care of damage to your personal after a crash, while full coverage safeguards against non-accident incidents such as stealing or natural disasters. Understanding these choices is crucial to selecting a coverage that meets your needs and wants.

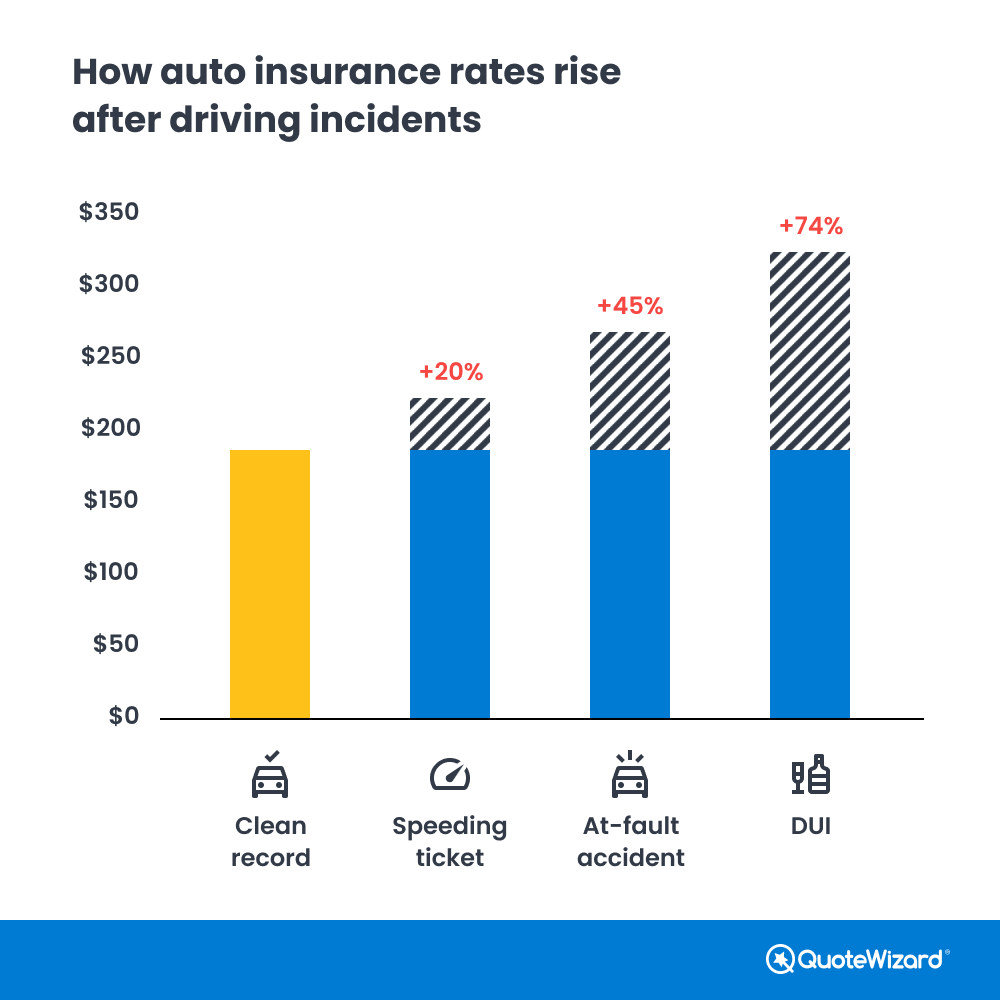

Factors influencing your vehicle coverage premiums include your driving history, the model of vehicle you drive, your credit rating, and the amount of protection you select. Providers evaluate these elements to determine the risk level they will accept when giving you coverage. It is essential to frequently examine your insurance and evaluate different insurance providers to verify you are getting the best value and coverage for your cost.

Reviewing Individual Insurance Requirements

Grasping one's individual insurance needs is vital in deciding on the best auto insurance policy. Commence by analyzing the vehicle's value, which plays a major role in determining the level of coverage needed. If you possess a newer or expensive car, you may want to consider comprehensive and collision coverage to protect your investment. Conversely, if you own an older vehicle, you might opt for liability coverage only, as it can be more affordable.

Then, think about your driving habits and individual risk factors. Should you frequently drive in crowded urban areas or engage in long commutes, you may face a higher risk of accidents, thereby necessitating a more extensive coverage plan. Additionally, assess your financial situation and how much you can afford as a deductible in the case of a claim. A higher deductible usually means lower premiums, but it is important to make sure that you can easily pay it should the need arise.

Ultimately, don't forget to account for any legal requirements specific to your state. Numerous states mandate a basic amount of liability coverage, but it is often advisable to opt for higher limits to safeguard yourself against likely lawsuits arising from accidents. By carefully evaluating these factors, you can make well-informed decisions that match your specific coverage needs and financial circumstances.

Evaluating Insurance Providers

When looking for the right auto insurance, it is essential to contrast various insurance providers. Each company offers different coverage options, premium rates, and customer service support. Commence by collecting quotes from multiple providers to find a variety of prices for similar coverage. This will assist you pinpoint the median cost and identify any outliers that may offer outstanding value or high charges.

Moreover, assess the coverage options provided through all insurer. Not all policy is designed equal; while one provider may offer comprehensive coverage at a competitive price, another might lack essential features. Seek supplementary benefits, like roadside assistance, rental car reimbursement, or accident forgiveness. Grasping what all provider includes in their policies can significantly impact your decision.

Lastly, evaluate the reputation and customer service of the insurance providers you are reviewing. Look into online reviews, ratings from external agencies, and feedback from friends. A company with a strong support system can make a significant difference when you must file a claim or have inquiries about your policy. Focusing on both cost and quality will guarantee that you choose an insurance provider that fulfills your needs successfully.

Assessing Discounts and Insurance Rates

When selecting car insurance, it's crucial to assess the different discounts available that can greatly reduce your premiums. Many insurance providers offer discounts for careful driving records, low mileage, multiple policy holders, and even for being a participant of particular organizations or associations. Be sure to inquire about any discounts you may qualify for, as these can lower your overall insurance cost and make your policy more affordable.

Evaluating premiums from various insurers is a necessary step in finding the most suitable auto insurance for your requirements. Each company uses its own measures to assess risk and determine policy rates, meaning that premiums can fluctuate widely between providers. Obtain proposals from multiple insurers and compare what coverage options and limits are included in each policy. This way, you can ensure that you are getting the greatest value for your premium.

Finally, consider how premium rates can change over time. Elements such as changes in your driving habits, credit score, or even the claims history of your insured vehicle can influence your premiums. Frequently reviewing your policy and shopping around for better rates can help you remain updated and ensure you're not paying excessively than necessary for your auto insurance. Keeping these factors in mind will help you arrive at a more informed decision that fits with your budget and coverage needs.

Examining the Detailed Print

As you selecting auto insurance, it is important to pay careful attention to the fine print of your policy. This section contains important details regarding limitations on coverage, exceptions, and distinct terms that could significantly affect your claims process. Many customers neglect these details, believing that their coverage is more comprehensive than it may actually be. Make an effort to take the time to review this information diligently to confirm you are fully knowledgeable of what is included and what is omitted.

Another key aspect to examine is the terms under which your policy will pay out claims. Some policies may have definite requirements for making a claim or may restrict coverage based on particular circumstances. Understanding these requirements will help you dodge surprises in the unlucky event of an accident. Ensure you know the timeline for reporting incidents, the evidence required, and any further stipulations that might come into play when seeking coverage.

Finally, be cautious of the terminology used in the fine print. Insurance documents often include technical terms that may not be familiar to everyone. If you find the language confusing, do not hesitate to ask your insurance agent for clarification. Knowing exactly what each term signifies can help you make an informed decision and ensure that you select the auto insurance policy that is most appropriate for your needs and provides you with sufficient protection.

Concluding Your Coverage Choice

When you have collected quotes and compared coverage options, it is necessary to make a conclusive decision regarding your auto insurance policy. Diligently review each policy's details to verify that it meets your individual needs. Pay attention to key aspects such as deductibles, coverage limits, and additional benefits or discounts that may be available. This will help you consider your options thoroughly and choose a policy that offers the best value for your needs.

Before committing to a policy, think about contacting to the insurance provider for any necessary clarifications or questions. Understanding cheapest car insurance Dallas and conditions is vital, as this can impact your financial responsibilities in the case of an accident or claim. Moreover, inquire about the claims process and customer service reputation of the insurer to guarantee a smooth experience when it counts most.

Once selecting your policy, take the time to review your decision regularly. Life transitions such as new cars, relocations, or changes in driving habits can modify your insurance needs. Frequently evaluating your auto insurance will help you stay adequately covered and may lead to potential savings if you identify better rates or coverage options in the market.