Vehicle insurance can often feel as if a complicated tangle, leaving many vehicle owners confounded by the variety of options and terminology. Regardless of whether you are a first-time buyer or looking to switch providers, understanding the details of car insurance is essential for shielding yourself and your vehicle on the road. This guide is crafted to help you navigate the challenges of car insurance, making the process easier and less daunting.

With a variety of policies, coverage options, and costs available, it's important to arm yourself with the insight needed to make informed decisions. From liability coverage to collision and comprehensive options, knowing what the terminology means and how it relates to your situation can save you hours and costs. By analyzing the key elements of car insurance, this guide will empower you to find the perfect policy tailored to your needs.

Grasping Vehicle Insurance Fundamentals

Auto insurance is a policy between the insured and an insurance provider that offers financial protection in the case of an incident, larceny, or harm to your vehicle. By paying a fee, you are insured for certain costs associated with vehicle-related events. Comprehending the fundamentals of auto coverage is crucial for selecting the appropriate policy and making sure you have proper coverage for your requirements.

There are various types of protection within auto insurance, including liability coverage, accident coverage, and all-encompassing coverage. Liability insurance helps cover losses to third parties and their assets if you are at responsible in an incident. Collision coverage covers harm to your own car after an incident, while comprehensive insurance protects against non-collision incidents like robbery or catastrophes. Understanding the differences between these kinds can help you formulate smart decisions.

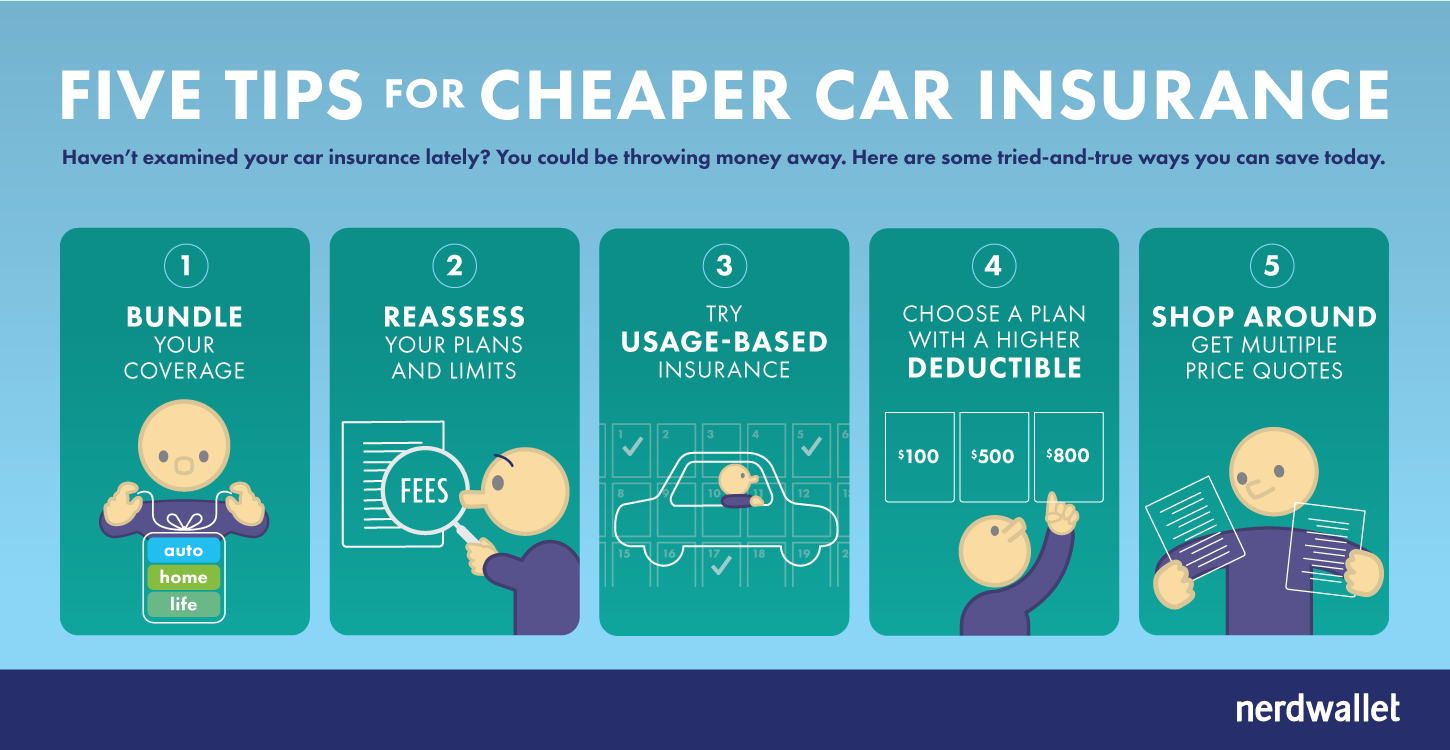

When picking a vehicle coverage plan, it is essential to consider factors like coverage limits, out-of-pocket expenses, and reductions. Increased coverage limits may provide superior protection but could cause elevated payments. Out-of-pocket expenses are the amount you cover yourself before the policy activates, and selecting a higher out-of-pocket expense can lower your cost. Numerous insurance companies also provide discounts for satisfactory driving histories, packaged coverages, or low mileage, which can additionally reduce your costs.

Types of Auto Insurance Coverage

As you think about car insurance, it's essential to know the different types of coverage available. The most common form is liability coverage, which is commonly required by law. This coverage protects you if you are found to be at fault in an accident, covering bodily injuries and property damage to others. It is imperative to have sufficient liability limits to shield your wealth in case of a major claim.

Another, essential type of coverage is collision insurance. This pays for the repairs to your vehicle after an accident, irrespective of who caused it. If your car is damaged in a collision, you can file a claim under this coverage to return to driving faster. While not mandatory, collision insurance is wise for drivers with more recent or expensive vehicles who want to defend their investment.

Comprehensive insurance is also a crucial part of auto insurance coverage. It safeguards against non-collision incidents, such as theft, vandalism, or natural disasters. This type of insurance makes sure you're covered for damages not caused by a collision, providing peace of mind for unexpected events. By combining comprehensive with liability and collision creates a complete insurance plan that protects you and your vehicle on the road.

Suggestions for Selecting the Right Coverage

As you choosing a car insurance policy, it is essential to assess your coverage needs based on your habits on the road, the kind of car you own, and your available funds. Factor in factors such as whether you use your car regularly, the frequency with which you encounter challenging circumstances, and the longevity and worth of your vehicle. Tailoring your policy to fit these considerations will help you prevent paying for unnecessary coverage while ensuring you are sufficiently protected.

It is also essential to compare different insurance companies and their policies. Invest some time to examine various providers to grasp their standing, customer service records, and claim handling. very cheap car insurance no deposit allow you to obtain quotes from multiple providers, thus simplifying the process of evaluation easier. Search for offers that may apply, including record of safe driving or merging auto insurance with other insurance plans. Each provider has its individual benefits, so explore your options to discover the most suitable option for your situation.

Finally, be sure to review the terms and conditions of the policy you are looking at. Comprehending the provisions, conditions, and exclusions is vital to make sure you know what is protected and what is not. Focus on the deductibles, maximums, and any additional coverages that may be needed for your particular situation. Taking the time to carefully review the policy information will help prevent unexpected costs down the road and give reassurance while on the road.